Exploring Short-Dated New Crop Options

- Ken Lake

- May 1, 2015

- 1 min read

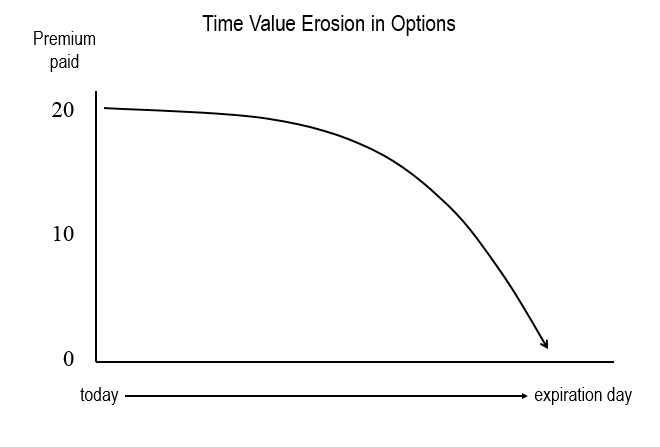

Options on Ag Futures have been around since the 1970’s. There are many components that go into option pricing and I’ve explained most of them in the past articles but today want to revisit the component of time value erosion and its effect on option value.

As an option buyer you are paying primarily for two things; intrinsic and time value. For example if Dec corn futures are trading at $3.80 and you buy an option with a strike price of 380 there is no intrinsic value but there is time value because a full-dated Dec corn option doesn’t expire until around Nov 22.

The closer we get to the expiration day, time value goes down as demonstrated in the graph below, to the extent that on expiration day time value is zero.

Recently the CME launched Short-dated options which offer:

Lower premiums than standard new crop options due to reduced time value

Cost-effective way to take a position in new crop futures contracts

Hedge a lower cost “window” version of traditional minimum price contracts

Precision timing to trade high impact events on new crop markets, such as USDA reports

Manage risk during specific windows of the growing season at reduced costs

The premium on a full-dated December 380 corn Put with and expiration day of November 22 is 26 cents.

Recent premiums for short-dated December 380 corn puts were as follows:

June (expires May 22) 5 cents

July (expires June 26) 11 cents

Aug (expires July 24) 17 cents

Sep (expires Aug 21) 19 cents

Contact you MAC Merchant if you are interested in using short-dated new crop options in your marketing plan.

Comments