Soybeans, Contract Lows to be Tested.

- Ken Lake

- Nov 1, 2018

- 2 min read

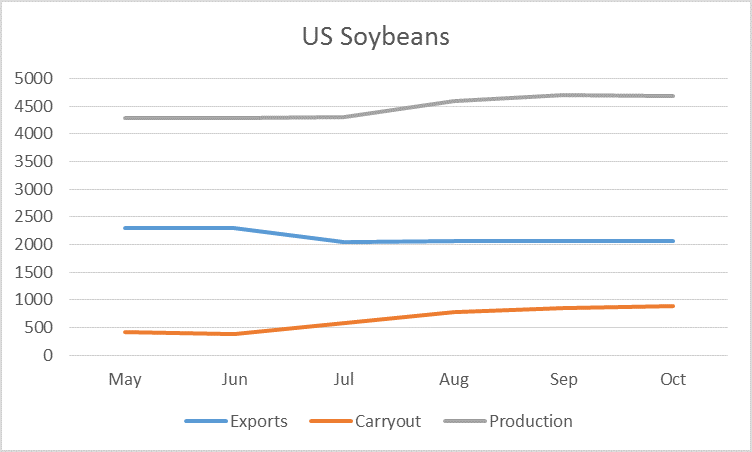

In previous weeks I’ve written about the idea that seasonal lows in soybeans were likely formed on September 18th. The continued export demand destruction is putting that idea in jeopardy. The chart below graphs USDA Supply and Demand numbers since May 2018. Growing crop size and lowered exports have resulted in a growing carryout. Since May the production estimate has grown 400 million bushels, exports have fallen 200 million bushels and the resulting carryout has grown 400 million bushels to 885 million bushels. Analysts fear that exports may fall another 300 million bushels pushing the US carryout number over a billion bushels. All in all, a very bearish situation. The numbers get updated next Thursday, November 8th. One should expect this market to be nervous until after the report is out. Support, and the recent low, in the November soybean contract, is 812.

The dynamics in the corn market are dramatically different than soybeans. The world balance sheet for corn is historically tight. Corn should divorce itself from the negativity in soybeans as some point. I would expect that to come in December once the harvest is complete and farmers have the crop tucked away. But don’t get bullish corn for too long. If the situation in soybeans don’t change we should see a massive switch from soybeans to corn acres in the spring. Corn marketing timelines should be moved ahead in the crop year for that reason. The December corn contract is oversold and tracking the 50 day moving average at 363, which is support. Moving averages in corn are pointing to a trend change. A close above 368 would be friendly.

It looks as if we have some support in the July 2019 wheat contract at 530. The contract is oversold. No sales recommendations at this time.

Comments